Treasury & MarketsTrader and Sales Foundation Course

| fmasg_treas_mkts_traders___sales_foundation_course_-_m_3___4_-_2022.pdf | |

| File Size: | 11531 kb |

| File Type: | |

Interview with Vietnam Wealth Association and AFA Capital

on the GameStop Short Squeeze Sage

on the GameStop Short Squeeze Sage

5 Feb 2021

|

Tung Hai University, Taichung, Taiwan - 30 Sep 2019

|

Le Meridien Hotel, Taipei, Taiwan - 1 Oct 2019

|

Participants' feedback on our training sessions

|

|

|

| pzh_trader___sales_foundation_course_feedback.pdf | |

| File Size: | 1011 kb |

| File Type: | |

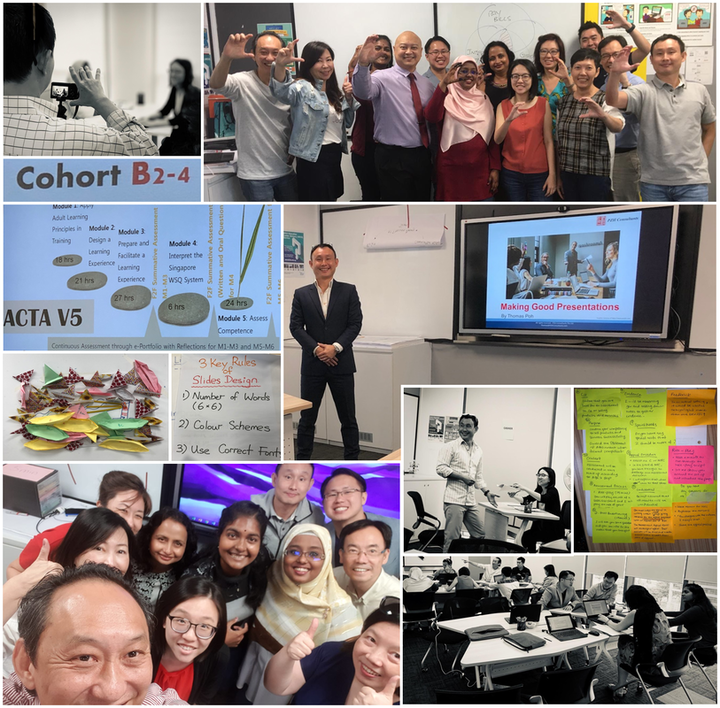

My ACTA Journey

12 Jul 2019 - Thomas Poh

|

CHICAGO! That is the code word for any Learner who has successfully achieved COMPETENCY which is what most of us would call a "Pass" for the Advance Certificate for Training and Assessment (ACTA). (For those that need to know, the alternate scenario is Not Yet Competent... ... )

Yes, it has been quite a journey for me since the day I had decided to sign up for ACTA. As an already practicing trainer, I admit that I had pre-conceived notions and much reservations of what to expect. How is this course going to help me? Am I re-learning what I already know? As it turns out, like all new experiences, it was definitiely an eye-opener and - in every sense of the word - a learning experience to remember ! |

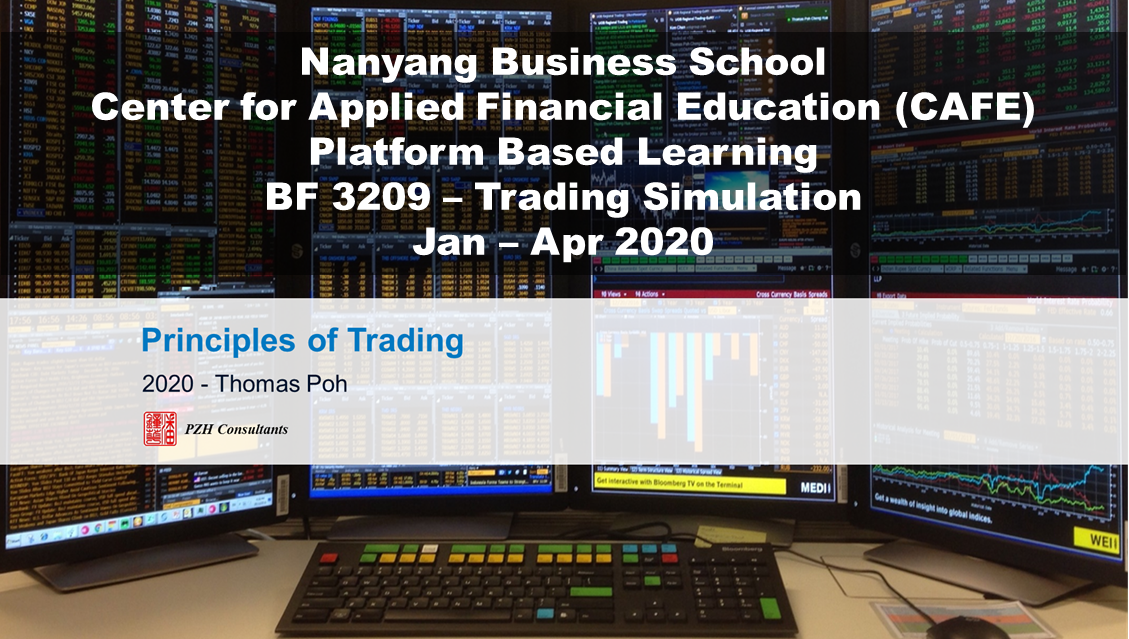

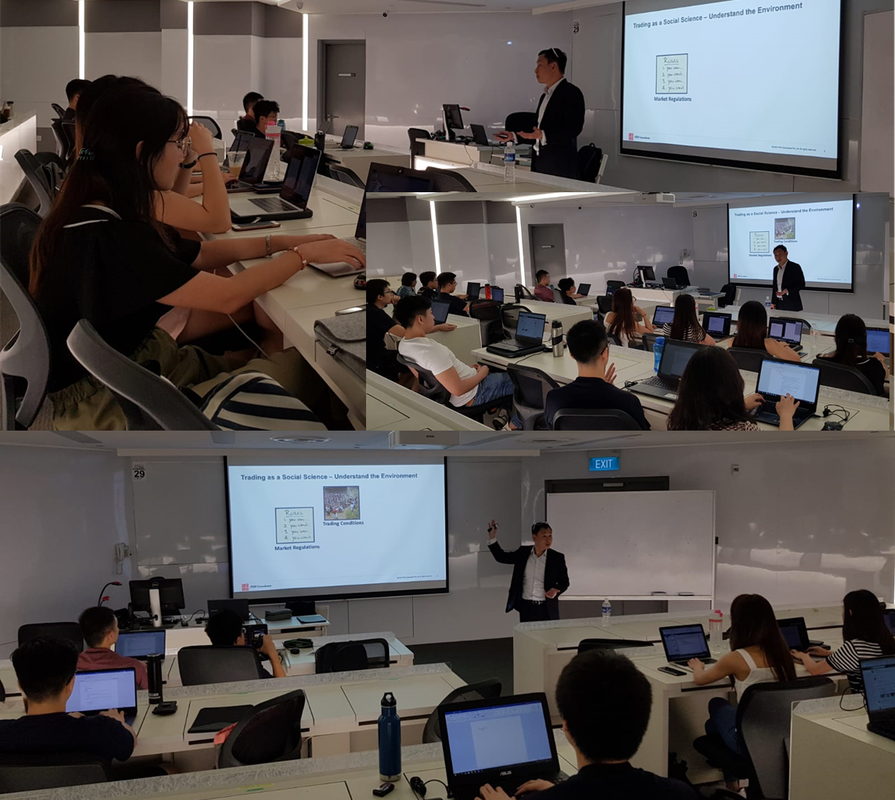

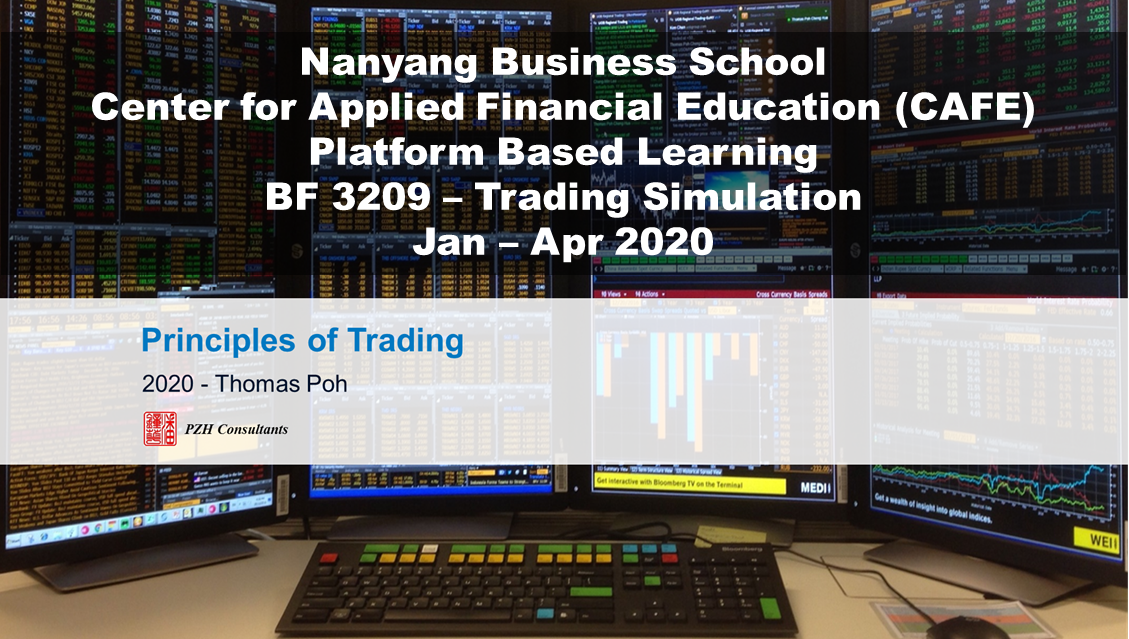

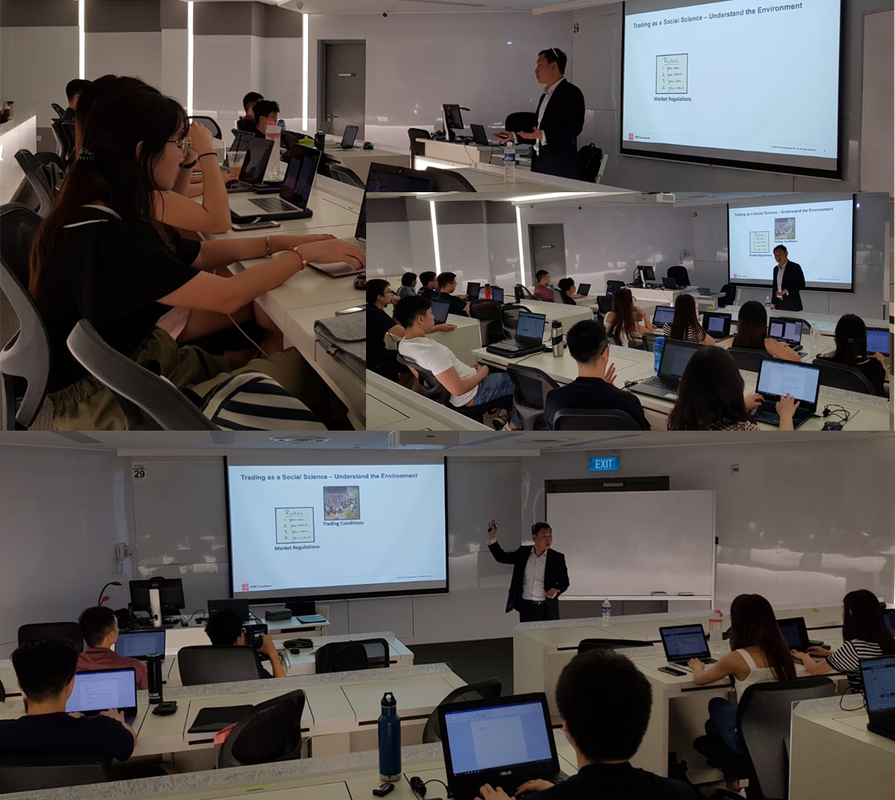

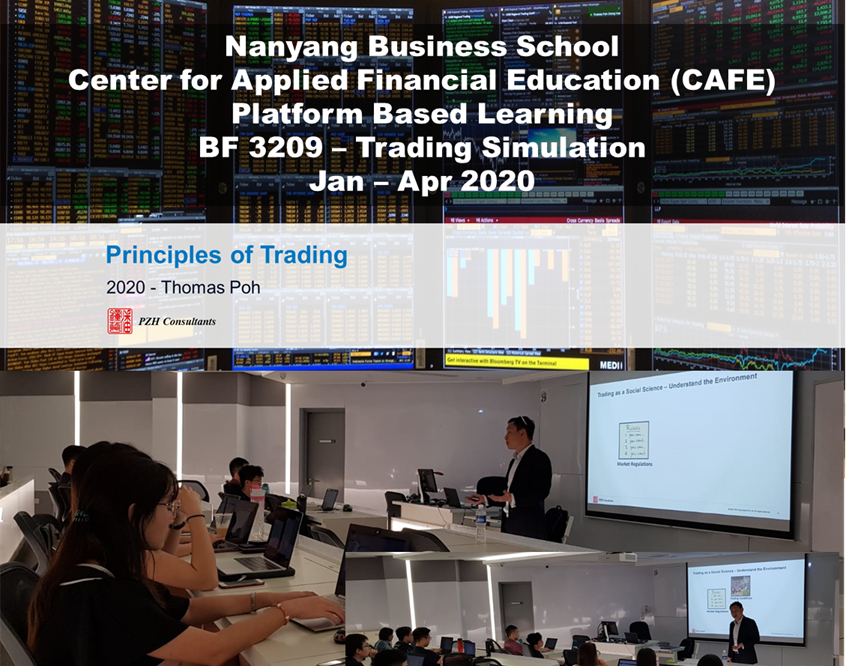

Trading Simulation Course as part of BF 3209, Platform Based Learning, Nanyang Business School

This Trading Simulation course is part of NTU Platform Based Learning ,BF 3209 undergraduate module. Spanning over 4 months, it creates a trading simulation based on actual live market conditions. The objective is to allow students to go through the actual process of trade idea identification, trade execution, risks management of the positions and their portfolio. This will reinforce their understanding on the concepts of trading so that they can apply these lessons when they enter the financial industry.

Is the Tide Turning for Asian FX?

- In partnership with SGX and Interactive Brokers (29th of Nov 2022 )

29Nov2022

Excited to be collaborating with Interactive Brokers and SGX of the upcoming webinar on 29Nov2022 6pm SGT!

https://ibkrwebinars.com/webinars/is-the-tide-turning-for-asian-fx/

As Asian markets have barely recovered from the pandemic, we are now facing spiraling inflation and recessionary fears. These twin shocks have set Asian FX on a depreciating trend on the back of a mega USD bull run. Has the tide turned? How and what should we use to position for the next move? What are the pitfalls to look out ahead? Join us where we will discuss these and more!

https://ibkrwebinars.com/webinars/is-the-tide-turning-for-asian-fx/

As Asian markets have barely recovered from the pandemic, we are now facing spiraling inflation and recessionary fears. These twin shocks have set Asian FX on a depreciating trend on the back of a mega USD bull run. Has the tide turned? How and what should we use to position for the next move? What are the pitfalls to look out ahead? Join us where we will discuss these and more!

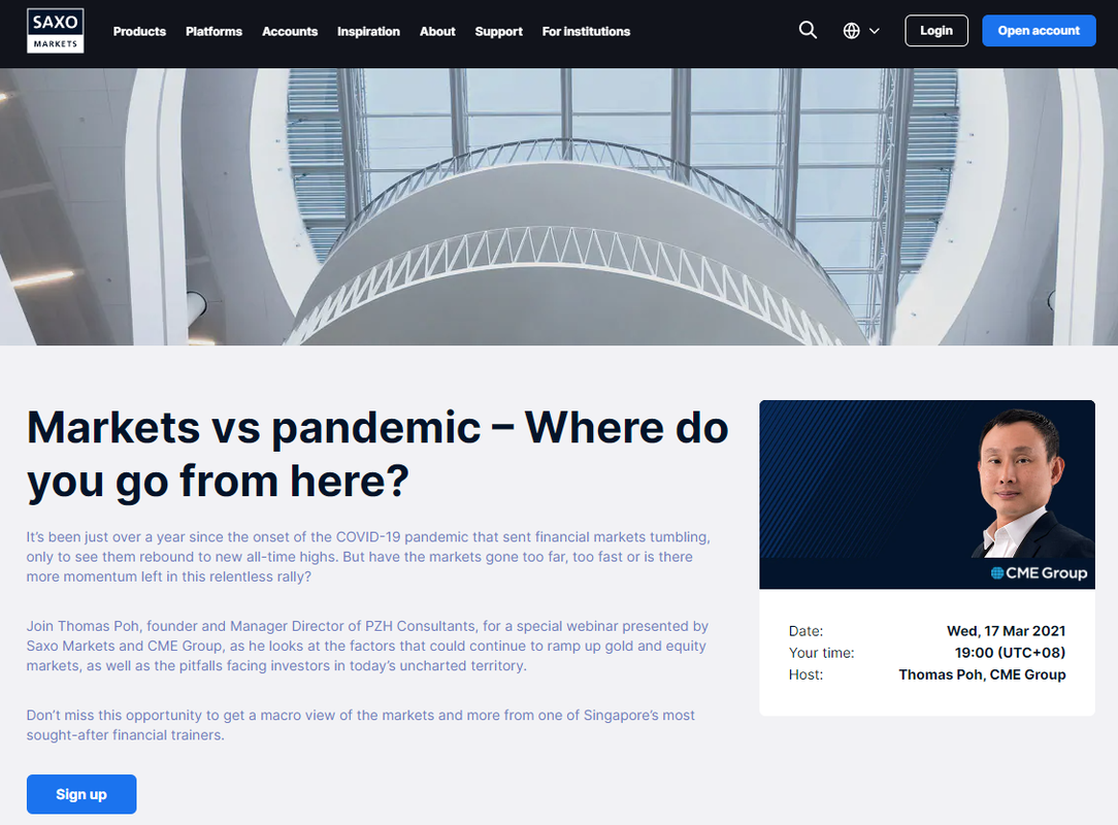

"Gaining the Edge - Understanding Market Dislocations"

- In partnership with CME Group and Interactive Brokers (4th of May 2020)

|

In this session, we will discuss the importance for investors to identify signs of market dislocations and why you should adopt a holistic approach towards analyzing this turbulent market. Join in to hear the following topics:

• What is going on in the market? What is market dislocations? • Importance of monitoring market dislocations and implications to your trading plan • Examples of market dislocation – past and present • Measures implemented to close the dislocations • How to leverage these implications into your trading plan |

Please click to watch the recording of the full presentation

"Gaining the Edge - Understanding Market Dislocations"

"Gaining the Edge - Understanding Market Dislocations"

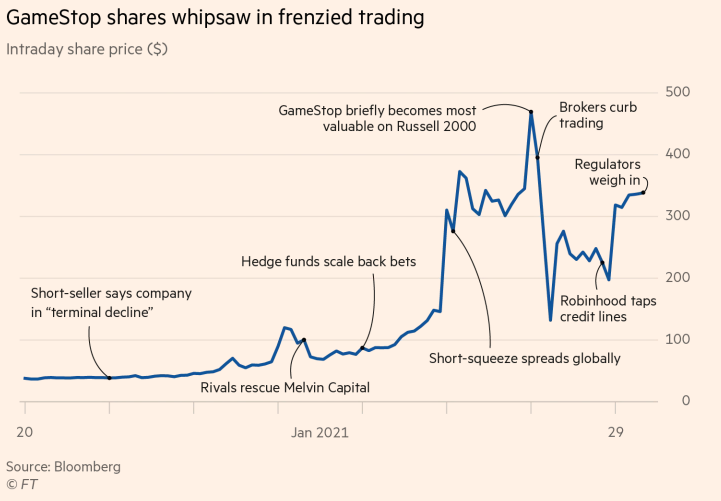

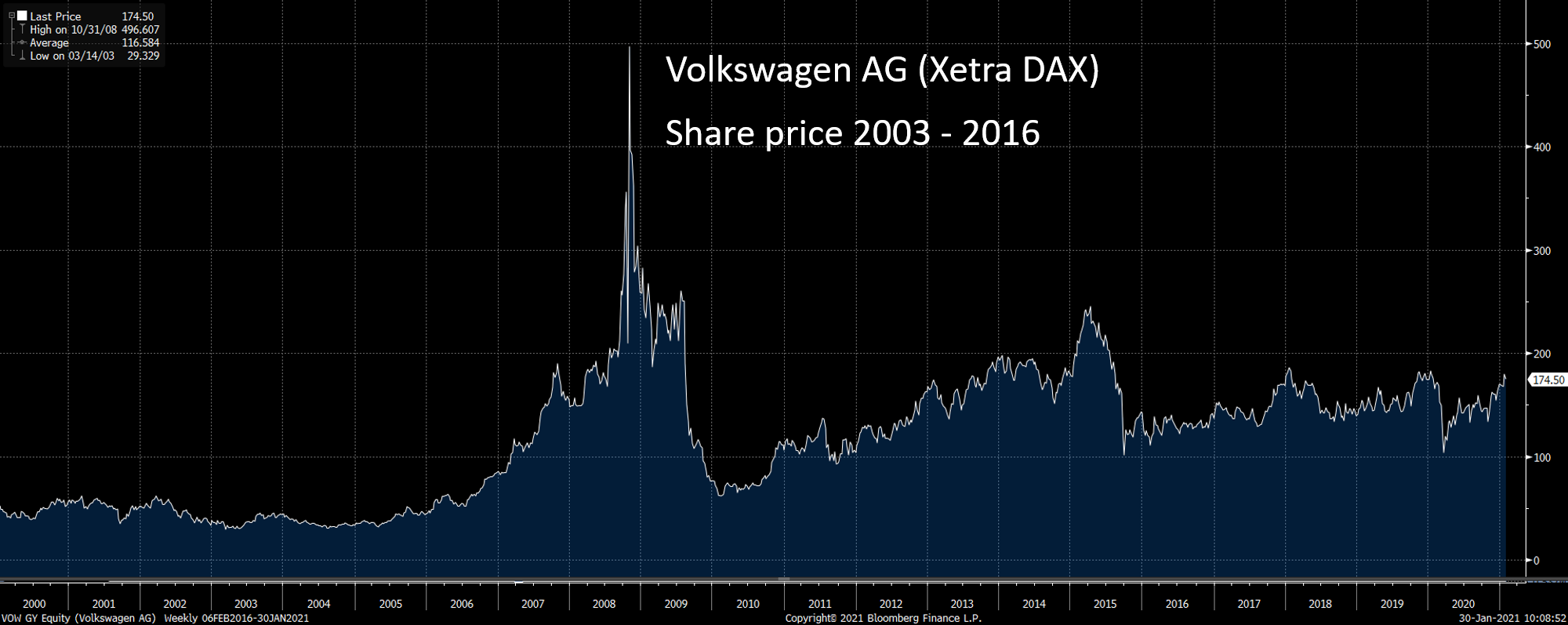

Be careful when flying to the Moon

30 Jan 2021 - Thomas Poh

|

Much has been published on the war between retail investors taking on hedge funds who are short stocks like GameStop and AMC. Speculators serve a function of facilitating price discovery, both long and short alike. Though the process, is seldom smooth (if ever), they are still a vital part of the market. Speculators take a position when the perceived rewards outweigh the calculated risks involved. Shorting a stock is inherent risky because of the unlimited loss that could be incurred as compared to a long position which is restricted to the notional value invested in the purchase. The short squeeze sparked by retail traders’ long call positions is simply forcing the shorts to re-assess these risk matrices.

Morality and political affiliations aside, this is the brutal laws of the financial market’s jungle functioning the way they are designed to be. Markets will always tend to squeeze crowded trades regardless of the direction. With 140% of outstanding free float being shorted, GameStop was a crowded short trade waiting to be squeezed. This is not the first time this has happened. Back in 2008 Volkswagen (VW) stock quadrupled and spiked to EUR1000 after Porsche announced an audacious takeover. But the real driver then was that the market quickly realised that the short positions is more than the total free float of the VW stock available in the market.(Shorting auto stocks were used as a proxy to short the market during the Lehman crisis as regulators banned the shorting of financial stocks) It is safe to say that most (if not all) the buyers of GameStop and all the related short squeeze trades are speculative in nature. Therefore, a strong word of caution to all the newly empowered retail traders,... ... |

Is the Tide Turning for Asian FX?

29Nov2022

Excited to be collaborating with Interactive Brokers and SGX of the upcoming webinar on 29Nov2022 6pm SGT!

https://ibkrwebinars.com/webinars/is-the-tide-turning-for-asian-fx/

As Asian markets have barely recovered from the pandemic, we are now facing spiraling inflation and recessionary fears. These twin shocks have set Asian FX on a depreciating trend on the back of a mega USD bull run. Has the tide turned? How and what should we use to position for the next move? What are the pitfalls to look out ahead? Join us where we will discuss these and more!

https://ibkrwebinars.com/webinars/is-the-tide-turning-for-asian-fx/

As Asian markets have barely recovered from the pandemic, we are now facing spiraling inflation and recessionary fears. These twin shocks have set Asian FX on a depreciating trend on the back of a mega USD bull run. Has the tide turned? How and what should we use to position for the next move? What are the pitfalls to look out ahead? Join us where we will discuss these and more!

Featured articles on Commercial Times 2 Oct 2019 |

Click to read more

《期貨論壇》台灣期信ETF 引領亞洲趨勢

創新化、國際化策略,高波動特性已成價差族最青睞交易工具 芝商所顧問Thomas Poh於1日針對「全球期貨交易之現況與未來發展」發表專題演講,除了分析期貨交易的優勢,更分享了目前三大商品期貨的驅動原因以及操作策略,藉此協助投資人對全球期貨交易動向有更深入了解... ... Click on photo below to see more articles

|

|

Kicked off a Trading Simulation course as part of NTU Platform Based Learning ,BF 3209 module on Wed. It has been a great honour and opportunity to be able to help shape the next generation of financial markets industry talents!

|

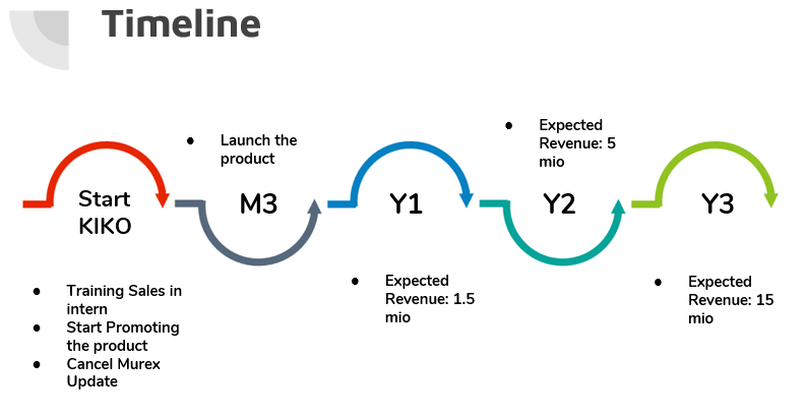

Virtual Mock Assessment Centre for ESSEC Business School

18-19 Nov 2020 - Thomas Poh

Inaugural Virtual Mock Assessment Centre for ESSEC Business School Masters of Finance graduates. Candidates gone through an intense 2-days course conducted virtually where they are required to participate in a role play based on a true life business scenario. A feedback session were then conducted on day 2 where both candidates and assessors share their experiences, learnings and observations.

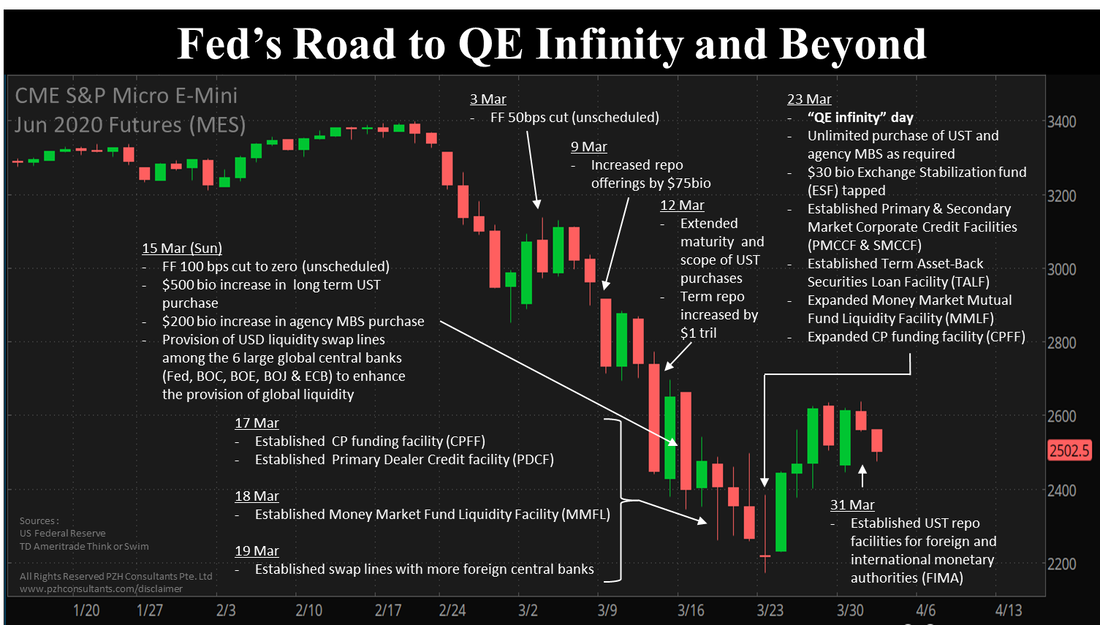

Fed’s Road to QE Infinity and Beyond (published on CME Group's website)

17 Apr 2020 - Thomas Poh

The COVID-19 outbreak has hit the world like a hurricane. The ongoing medical and humanitarian crisis has also sparked off an economic and financial one. As the world realised that the virus knows no borders, global financial markets tanked. The longest stock market bull run in history ended in the most dramatic fashion as the S&P 500 lost as much as 34%, at its lowest point, on 23rd March.

As countries go into lockdown and the stock market went through a tsunami-styled selloff, secondary tremors were immediately felt across all other asset classes. These asset markets went through huge (some unprecedented) market dislocations, driven by one major common theme, FUNDING. Leading bond ETFs were trading at deep discounts against their NAVs and the USD index rose by almost 9%. The three-month Libor jumped 16bps on 17th March 2020 while the price of Jun 2020 futures indicated Libor vs SOFR spread to be as high as 57 bps at maturity. At one stage, the market even started to sell treasuries and gold simply to raise cash, ignoring their usual flight to safe-haven assets.

Click on the link below to read the full article

https://www.cmegroup.com/education/articles-and-reports/feds-road-to-qe-infinity-and-beyond.html

As countries go into lockdown and the stock market went through a tsunami-styled selloff, secondary tremors were immediately felt across all other asset classes. These asset markets went through huge (some unprecedented) market dislocations, driven by one major common theme, FUNDING. Leading bond ETFs were trading at deep discounts against their NAVs and the USD index rose by almost 9%. The three-month Libor jumped 16bps on 17th March 2020 while the price of Jun 2020 futures indicated Libor vs SOFR spread to be as high as 57 bps at maturity. At one stage, the market even started to sell treasuries and gold simply to raise cash, ignoring their usual flight to safe-haven assets.

Click on the link below to read the full article

https://www.cmegroup.com/education/articles-and-reports/feds-road-to-qe-infinity-and-beyond.html

Interview with Vietnam Wealth Association and AFA Capital

on the GameStop Short Squeeze Saga

on the GameStop Short Squeeze Saga

5 Feb 2021

Click to read more

Riding Asia’s Emerging Financial Markets – Opportunities & Risks

|

Asia’s Emerging Financial Markets (AEFMs) can be diverse and complex. Currencies are not freely traded. Markets can be volatile and derivative products available for hedging are not fully developed. All of which could have significant impact on funding, hedging and risk management decisions. Ground knowledge and insights to regulations, hidden costs and other market idiosyncrasies could provide competitive advantage in AEFMs. This workshop aims to provide a practitioner’s approach to maximise opportunities and avoid potential painful pitfalls.

|

Click to read more

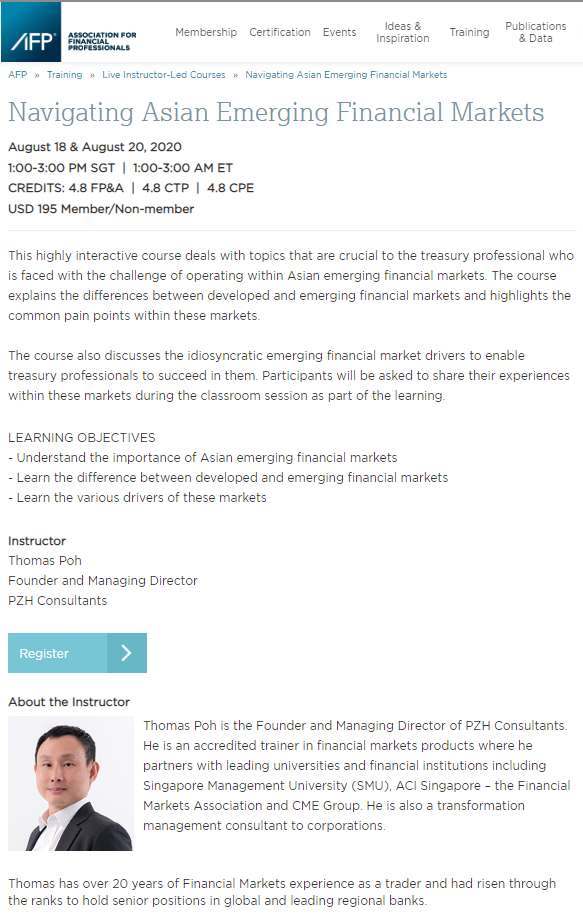

Navigating Asian Emerging Financial Markets

|

Are you are keen to know what the key differences between Emerging and Developed Markets are?

What really drives these markets? How about learning a framework to help you succeed and avoid the landmines when venturing into Asian Emerging Market? You need not look further! In collaboration with the Association of Financial Professionals, we are proud to present to you our 4-hour online course on Navigating Asian Emerging Financial Markets. Enrollment is now opened ! Click on the link to sign up now! https://www.afponline.org/training/training/live-instructor-led/navigating-asian-emerging-financial-markets |

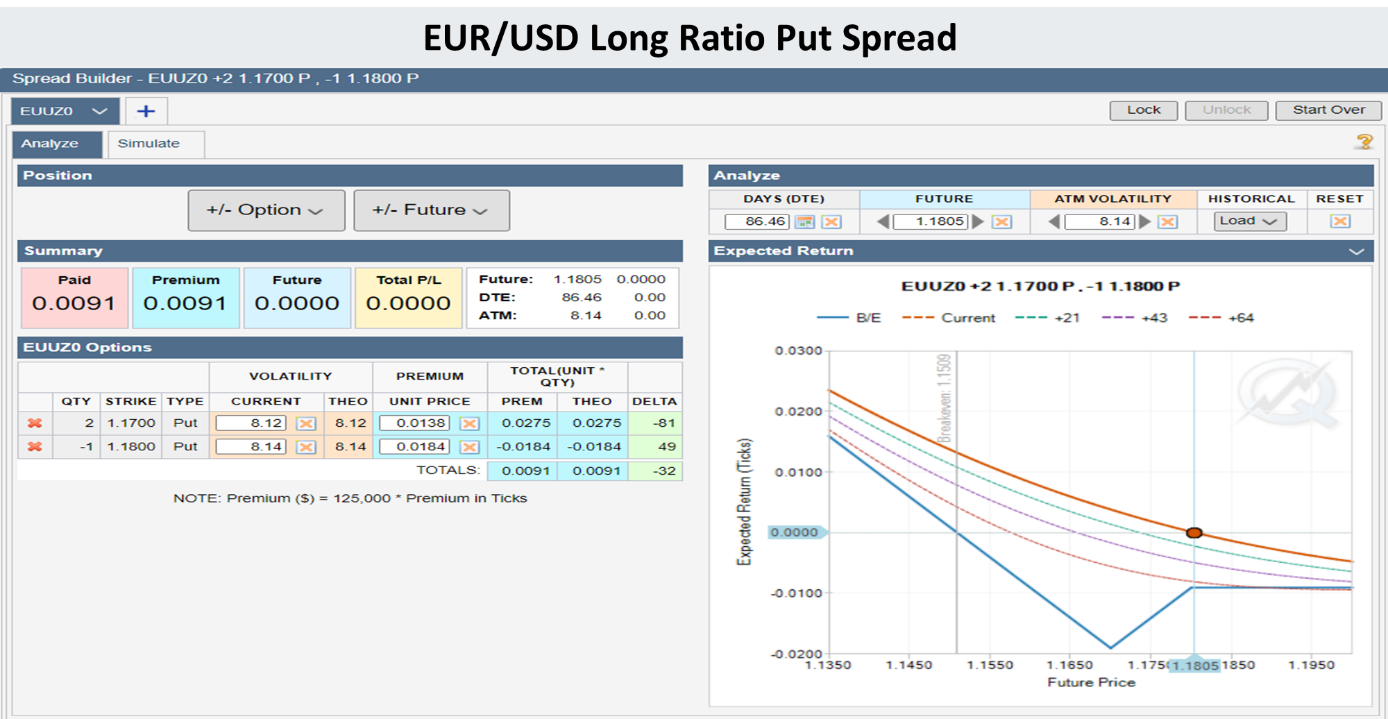

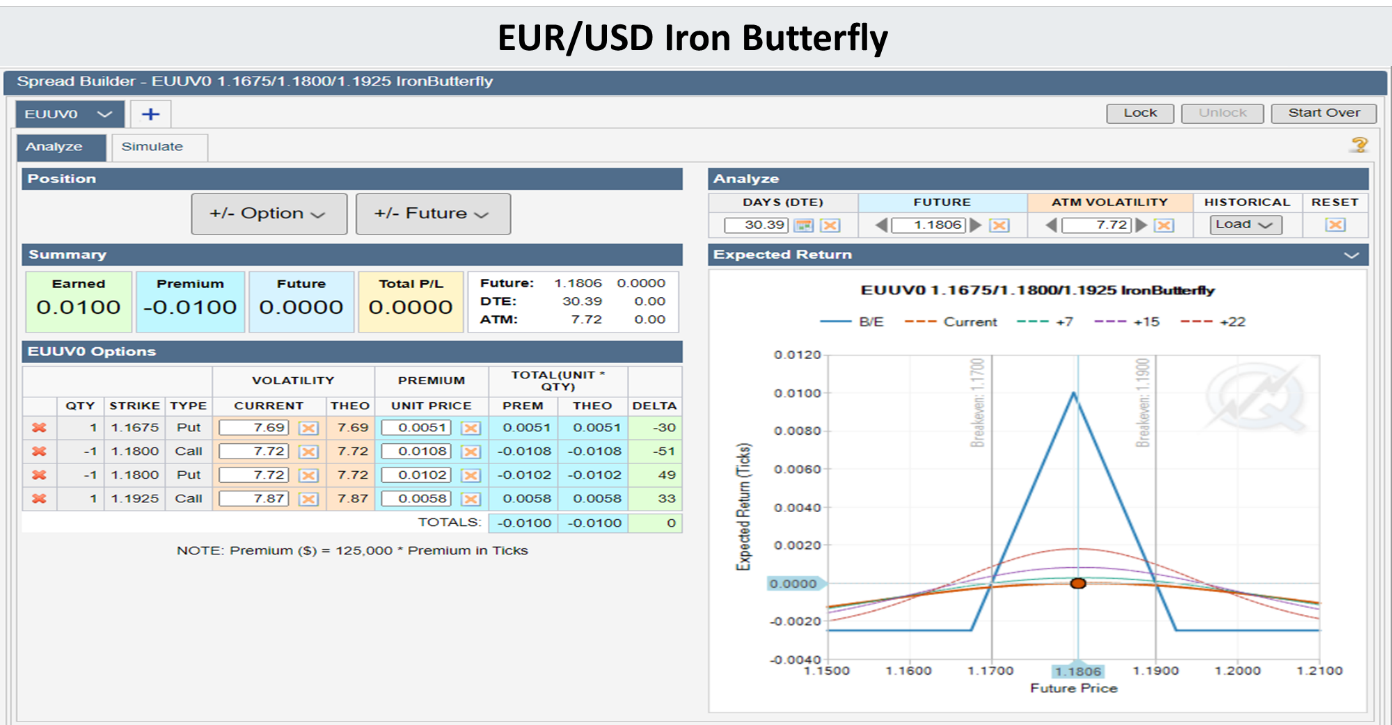

FX Options: An Alternative Way to Trade FX for Retail and Financial Institutions

(published on CME Group's website)

15 Sep 2020 - Thomas Poh

FX trading opportunities aheadIt has been over six months since the COVID-19 pandemic hit the global economy and sent financial markets into one of the wildest rides ever seen. Extreme market volatility was seen across all markets with unprecedented markets dislocations. With the Fed’s intervention, by announcing QE Infinity in March, financial markets has since embarked on a dramatic turnaround. Gold and Nasdaq both hit all-time highs, while yields dropped to rock bottom. The FX market also went on a roller coaster ride. The DXY Dollar-index made a big reversal since its near 9% spike in March mainly driven the Fed’s relief measures, the eurozone’s agreement to a EUR 750 billion pandemic fund, and the escalation of the COVID-19 spread in the US

.

Click on the links below to read the full article

https://www.cmegroup.com/education/articles-and-reports/fx-options-an-alternative-way-to-trade-fx.html

https://www.cmegroup.com/education/articles-and-reports/navigating-the-choppy-markets-with-fx-options-a-retail-traders-perspective-on-fx-trading.html

.

Click on the links below to read the full article

https://www.cmegroup.com/education/articles-and-reports/fx-options-an-alternative-way-to-trade-fx.html

https://www.cmegroup.com/education/articles-and-reports/navigating-the-choppy-markets-with-fx-options-a-retail-traders-perspective-on-fx-trading.html

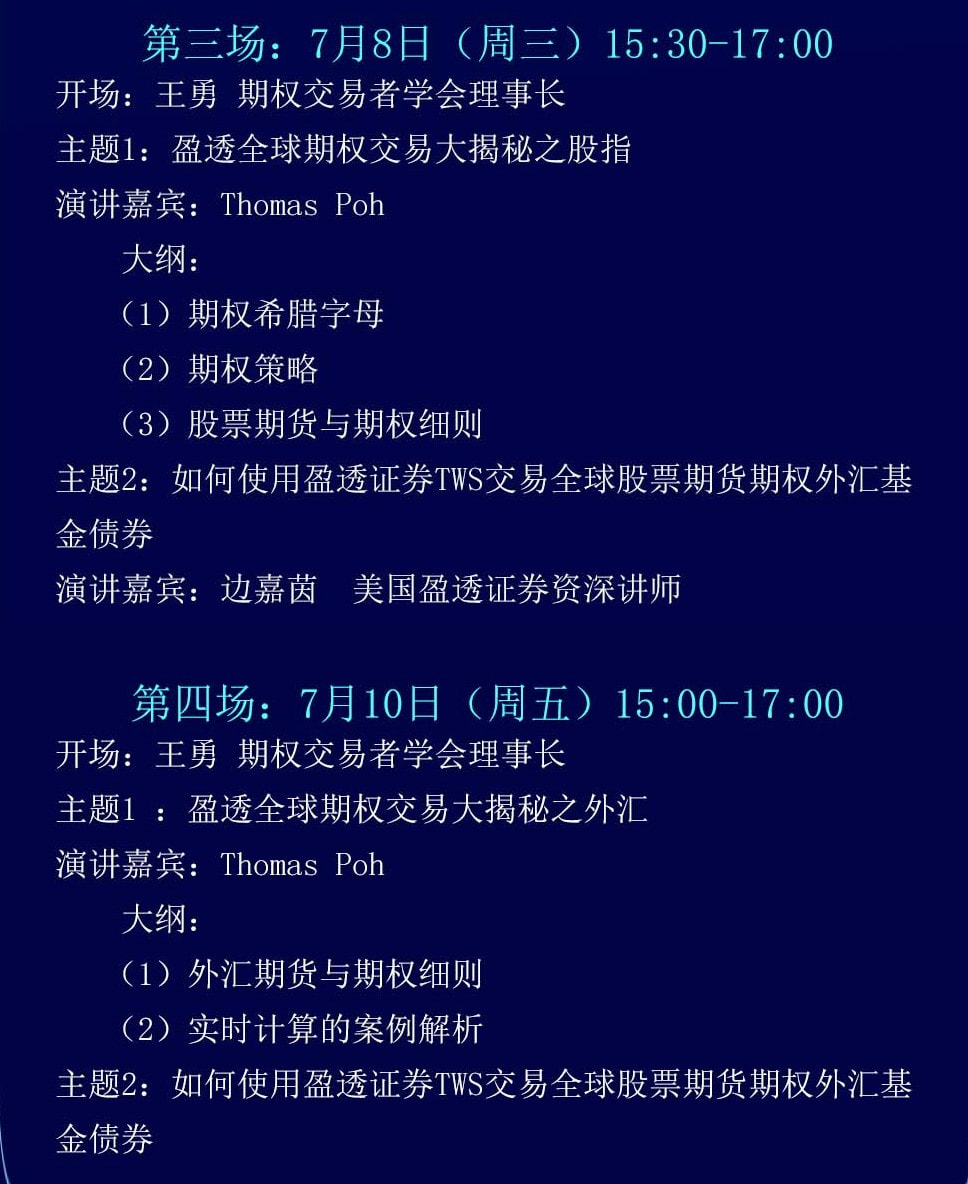

3 Part Futures training series with FUTU HK and CME Group

- Part 2 Drivers of FX Markets

12 Aug 2021

3 Part Futures training series with FUTU HK and CME Group

- Part 1 Basics of FX Futures

05 Aug 2021

BF 3209 - Students' feedback survey

BF 3209 - Students' feedback survey

Click to read more

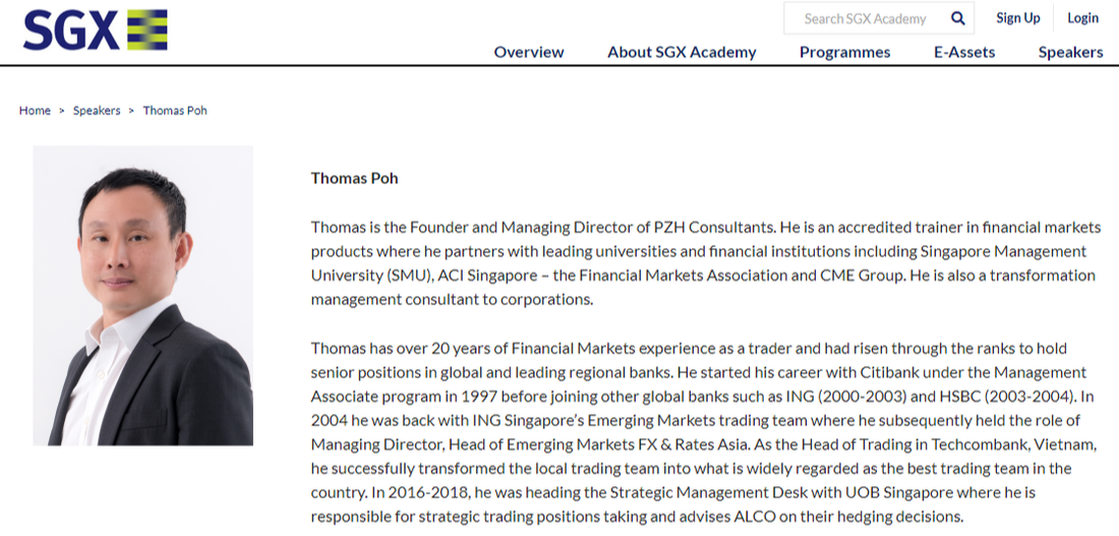

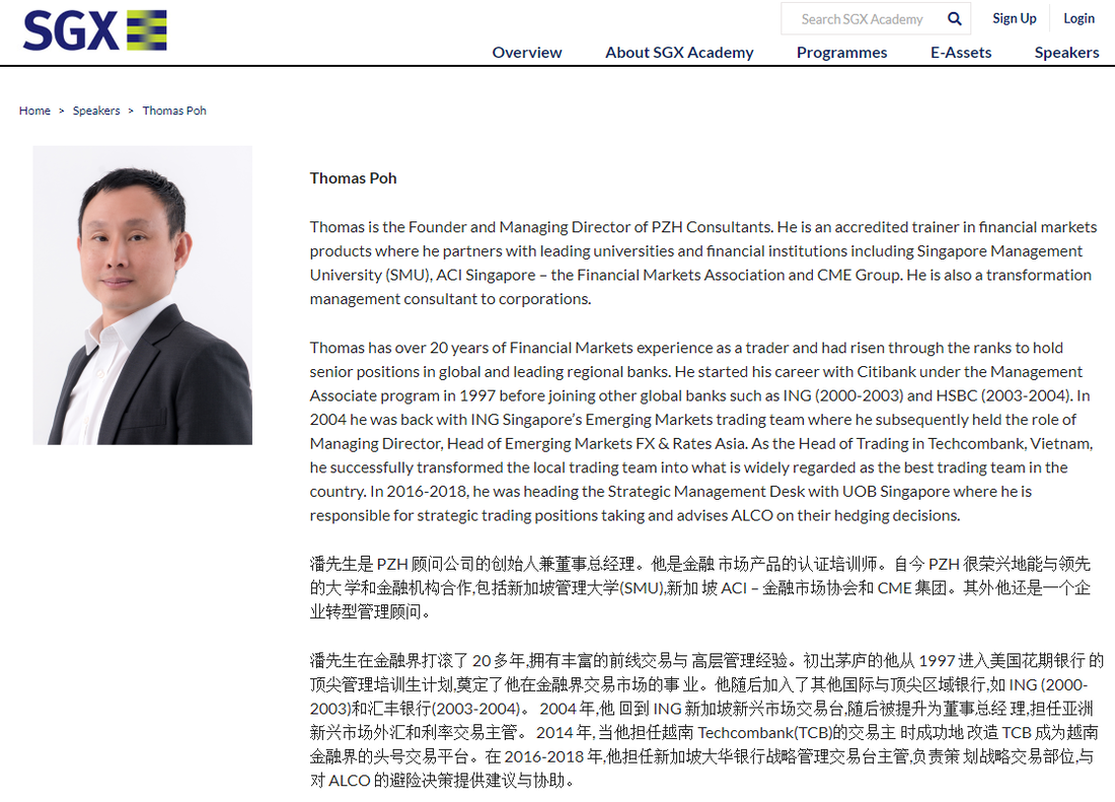

Appointed Speaker for SGX Academy

Click to read more

SMU-Deloitte Corporate Financial Risk Management Masterclass |

The SMU-Deloitte Corporate Financial Risk Management Masterclass is a series of two-day workshops that provide a holistic approach to effective foreign exchange, liquidity and debt management.

This Oct workshop focuses on Foreign Exchange (FX) risk management. Delivered through a combination of lectures, case discussions and sharing from practitioners, participants will gain practical knowledge and valuable insights to identify currency risks and effectively manage FX exposures in their organisations. Thomas Poh

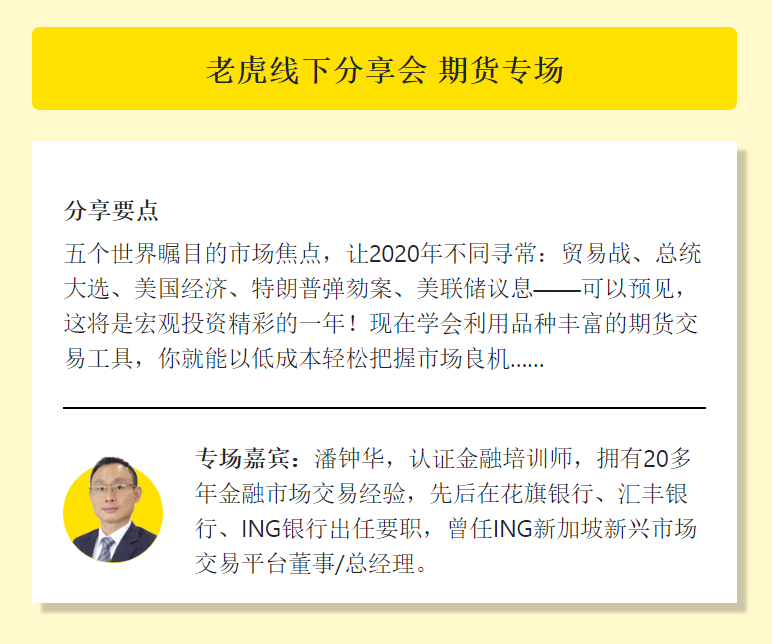

Facilitator SMU Academy Thomas has 20 over years of experience in trading and managing FX, interest rate and derivative products in Emerging Markets for global banks. He left the banking sector to head up his own training and consulting company in 2018. |

SCHEDULE

START DATE(S) 11 Oct 2019 (Fri) INTAKE INFORMATION11 & 12 Oct 2019 (Fri & Sat) Program is held from 9am - 5pm |

Copyright © 2019 PZH Consultants Pte. Ltd. All rights reserved.

|

|

|

The entire ACTA course and assessment covers 6 modules over 102 hours of lessons and spanning 4 months. Although 102 hours over a 4-month period do not seem much, this does not include the time spent on preparing deliverable and group work. In addition, this is my first experience attending a prolong course as an Adult Learner. With it, comes challenges with schedule management and simply getting used to classroom learning after an absence of 25 years. In the weeks that followed, I became one of the classic example of a typical Adult Learner that ACTA is preparing us to train!

For starters, I had to do quite a fair bit of "un-learning". As the saying goes, you cannot fill a bucket that is already full. Throughout the course, I constantly get to clear out cobwebs in my mind. It is not everyday that you get to spring clean your thoughts in your mind. I had to learn the theory behind the science and art of training which helped put my real-world life experiences into perspective and reorganize them into a more holistic mental model

Group work is the other highlight of this ACTA course. I had the pleasure to work with a group of awesome course mates. Given the diverse backgrounds and industries that we come from, each participant brought with them different yet rich life experiences. This diversity really opened up my mind and take on different perspectives. As Confucius says: 三人之行,必有我师 which vaguely means "we will always learn something when we are in the company of others". Coming from a relatively niche part of the financial industry, this interaction with my group mates from different industries serves as a good opportunity to reflect on how silo-ed one is after years working on the trading floor. Like the Chinese saying, 读万卷书,不如行万里路 - nothing beats learning from people as compared to reading from books and market reports.

And then, there are my 2 trainers. Which cannot be more different in their styles and approaches. I have re-learnt that there are indeed many ways to skin the cat. Observing my trainers in action became a learning experience itself. Scenes of Leonardo DiCaprio's "Inceptions"-like scenarios keep repeating themselves during the course as we had role-plays on how to do role-plays and I even made a presentation on "how to make a good presentation" (within a course that teaches good presentation skills!).

So now, I am proud and happy to say that I too, have joined the many that have been graded Chicago. I would like thank my trainers Darren Tjia and Wendy Wan for their time and patience as well as my classmates for their support and camaraderie that have made this a memorable experience. Something to share as I continue on my new journey as a trainer and consultant.

Never... stop... learning.

For starters, I had to do quite a fair bit of "un-learning". As the saying goes, you cannot fill a bucket that is already full. Throughout the course, I constantly get to clear out cobwebs in my mind. It is not everyday that you get to spring clean your thoughts in your mind. I had to learn the theory behind the science and art of training which helped put my real-world life experiences into perspective and reorganize them into a more holistic mental model

Group work is the other highlight of this ACTA course. I had the pleasure to work with a group of awesome course mates. Given the diverse backgrounds and industries that we come from, each participant brought with them different yet rich life experiences. This diversity really opened up my mind and take on different perspectives. As Confucius says: 三人之行,必有我师 which vaguely means "we will always learn something when we are in the company of others". Coming from a relatively niche part of the financial industry, this interaction with my group mates from different industries serves as a good opportunity to reflect on how silo-ed one is after years working on the trading floor. Like the Chinese saying, 读万卷书,不如行万里路 - nothing beats learning from people as compared to reading from books and market reports.

And then, there are my 2 trainers. Which cannot be more different in their styles and approaches. I have re-learnt that there are indeed many ways to skin the cat. Observing my trainers in action became a learning experience itself. Scenes of Leonardo DiCaprio's "Inceptions"-like scenarios keep repeating themselves during the course as we had role-plays on how to do role-plays and I even made a presentation on "how to make a good presentation" (within a course that teaches good presentation skills!).

So now, I am proud and happy to say that I too, have joined the many that have been graded Chicago. I would like thank my trainers Darren Tjia and Wendy Wan for their time and patience as well as my classmates for their support and camaraderie that have made this a memorable experience. Something to share as I continue on my new journey as a trainer and consultant.

Never... stop... learning.

|

|

|

SMU-Deloitte Corporate Financial Risk Management Masterclass |

FX ManagementGlobalisation and digitisation are driving the transformation of finance and treasury functions. Senior finance professionals need to move beyond their traditional roles as stewards to become strategists and catalysts for change in their organisations.

Recognising the challenges arising from market volatility and technology disruption, Deloitte and Singapore Management University are collaborating to offer a series of Corporate Financial Risk Management Masterclasses at the SMU Academy. The SMU-Deloitte Corporate Financial Risk Management Masterclass is a series of two-day workshops that provide a holistic approach to effective foreign exchange, liquidity and debt management. This Oct workshop focuses on Foreign Exchange (FX) risk management. Delivered through a combination of lectures, case discussions and sharing from practitioners, participants will gain practical knowledge and valuable insights to identify currency risks and effectively manage FX exposures in their organisations. |

Thomas Poh

Facilitator SMU Academy Thomas has 20 over years of experience in trading and managing FX, interest rate and derivative products in Emerging Markets for global banks. He left the banking sector to head up his own training and consulting company in 2018. SCHEDULE

START DATE(S) 11 Oct 2019 (Fri) INTAKE INFORMATION11 & 12 Oct 2019 (Fri & Sat) Program is held from 9am - 5pm |

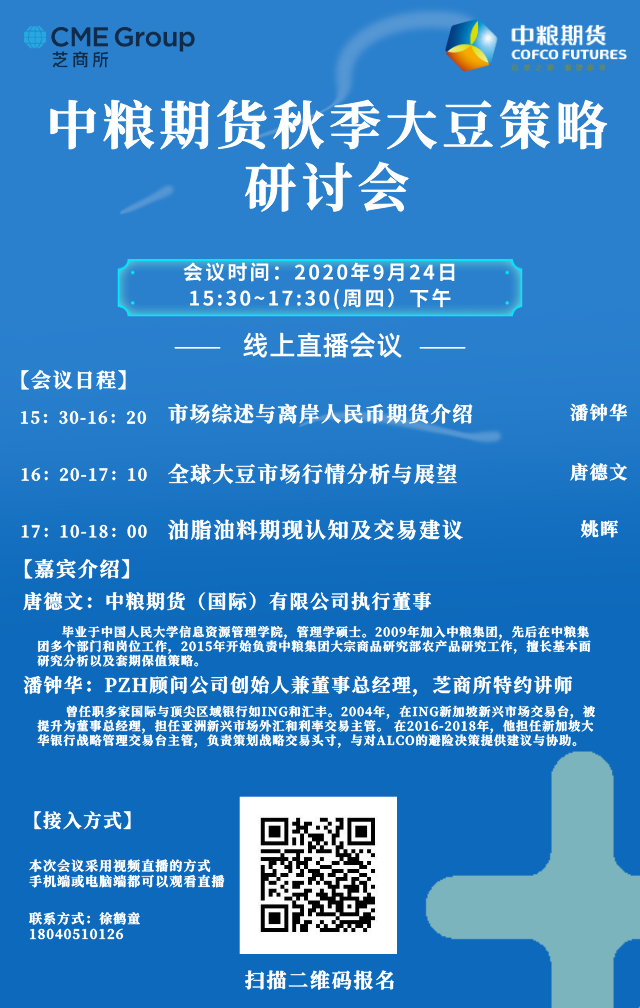

掌握變動局勢下金融交易趨勢與避險策略探討 |

-舉辦目的-

目前美中貿易紛爭難免影響全球經濟成長,而投資人如何因應全球經濟放緩、美中貨幣政策如何牽動全球匯率市場波動、英國脫歐議題所引發的地緣政治風險、美國公債殖利率倒掛是否代表經濟已步入衰退?...等這些都是近期讓投資人既關心也擔憂的議題。 有鑒於此,台灣金融研訓院將陸續舉辦「決戰全球金融市場系列」研討會,持續聚焦資本市場商品創新之相關議題,邀集專家從投資銀行、套利交易者、避險基金等多元視角,深入剖析金融市場未來發展與創新動態。此次與芝商所(CME Group)共同舉辦「掌握變動局勢下金融交易趨勢與避險策略探討」,期望透過專家分享經驗與專業見解,協助金融機構與國內相關投資者提升產業資訊,掌握市場現況與未來趨勢 |

|

Copyright © PZH Consultants Pte. Ltd. All rights reserved.

|